Looking Ahead: Global Digital Ad Spend in 2022

Which countries will be the top digital ad markets in 2022?

Digital ad spending is growing, we all know this.

But where exactly is the growth concentrated? Is it in Europe, North America, Asia?

eMarketer released an important forecast earlier this year that showed where digital ad spend growth was concentrated around the world.

We are going to delve deep into the numbers and see what exactly the world of digital advertising is going to look like four years from now in 2022.

Which countries are experiencing the fastest growth? Which regions are stagnating?

All of the graphs and charts are based on eMarketer’s forecast report which you can read here.

Want to take full advantage of this global growth in your digital advertising strategies? We built several smart advertising solutions specifically designed to capture international digital advertising markets.

Intro

According to eMarketer, digital's share in overall advertising will reach 50% by 2022.

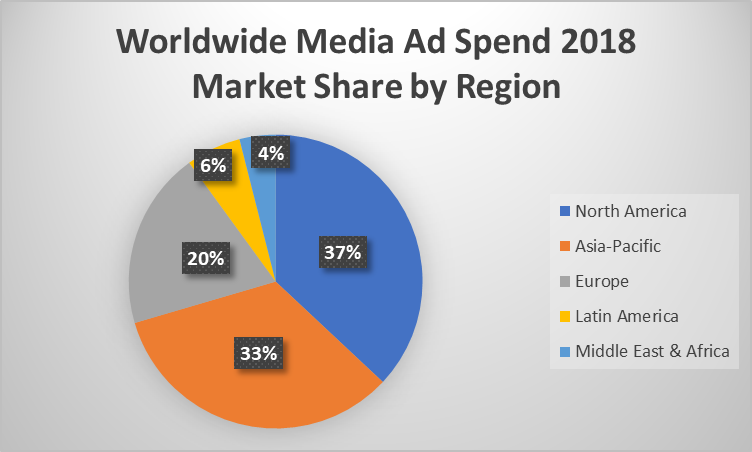

The Asia-Pacific region and North America will account for 70.5% of the $628 billion global ad spend in 2018. This comes against the backdrop of strong consumer spending and the Fifa World Cup.

North America will remain the biggest advertising market in 2018, posting $232 billion, closely followed by the Asia-Pacific region at $210 billion.

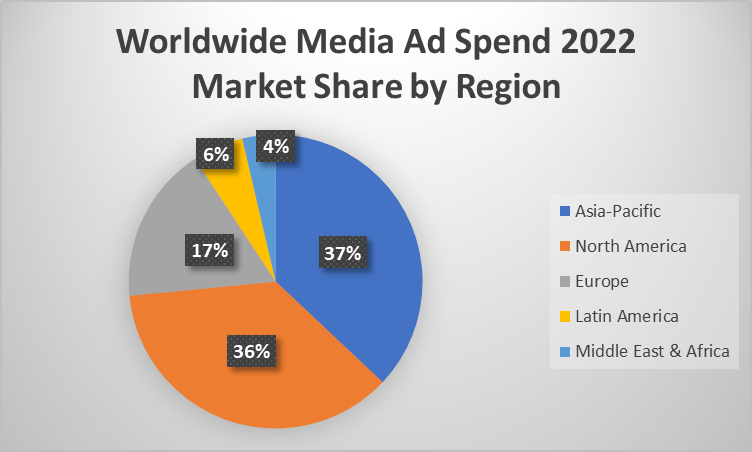

But according to the report, North America will not remain the top market for long. The Asia-Pacific region is expected to overtake North America as the top advertising market already by 2022.

Of these two regions, the United States and China will remain the biggest single country markets.

But what about the rest of the world? What other countries are set to see the most digital ad growth in the next four-year period?

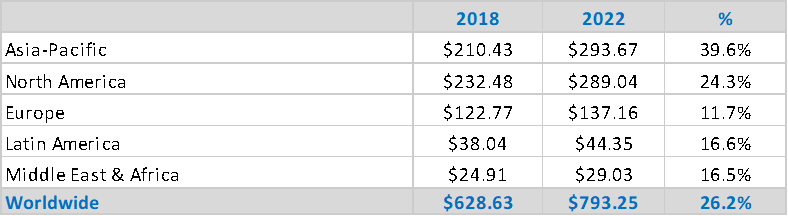

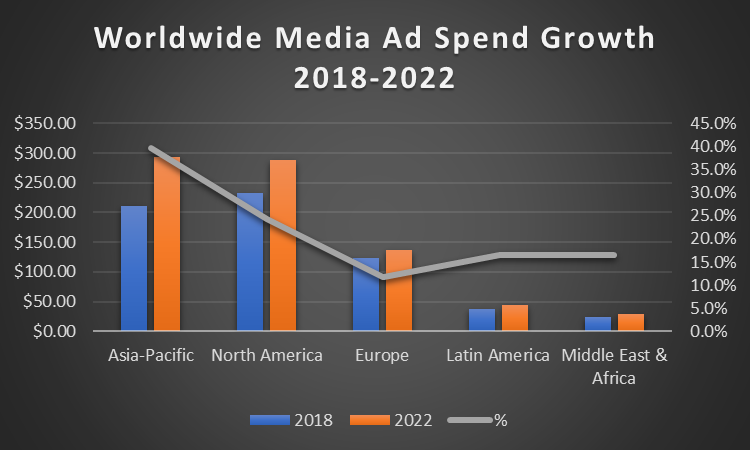

Worldwide Total Media Ad Spend

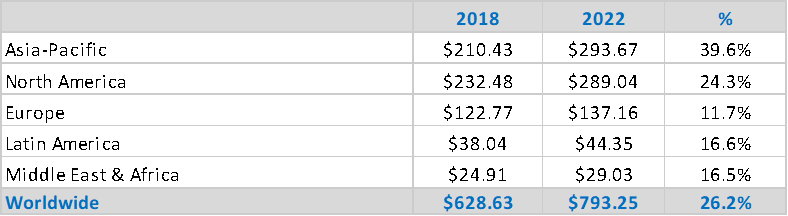

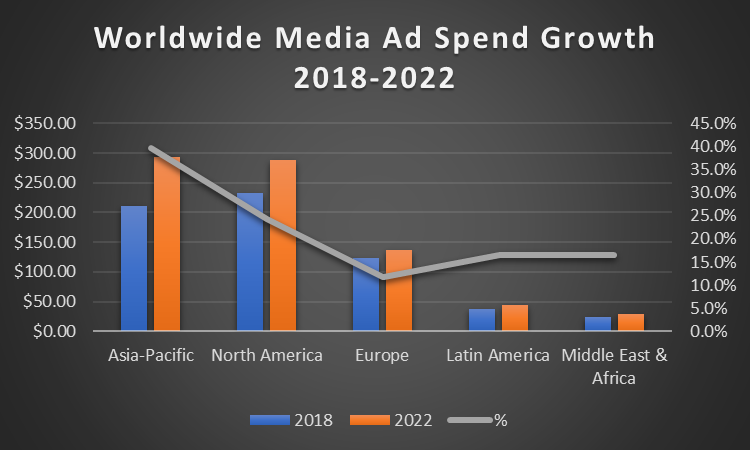

According to the report, total media ad spending worldwide is going to rise 26% between 2018 and 2022, from $629 billion in 2018 to $793 billion in 2022.

During this time, the Asia-Pacific region is projected to overtake North America as the largest media ad spend market in the world. This is almost exclusively a result of massive growth in China.

In 2018 North America’s share of global media ad spend stands at 37%, while Asia accounts for 33%. By 2022, Asia will account for 37% while North America will slip to 36%.

Europe on the other hand will see a 3% decline over the next four years, falling from 20% to 17% of overall global media spend.

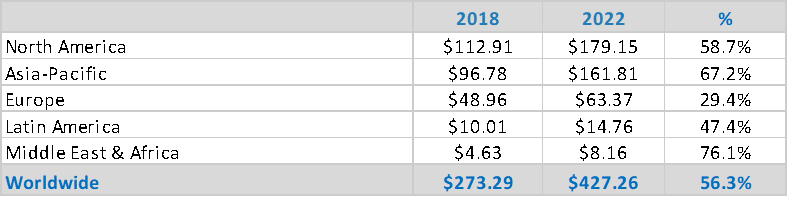

Worldwide Digital Ad Spend

Total media spend includes traditional advertising mediums like TV, print and radio.

When we take those out and focus solely on digital we get a different picture of the world.

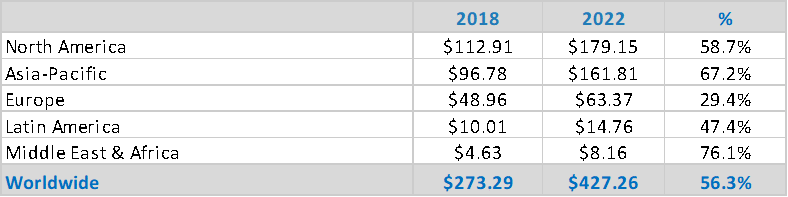

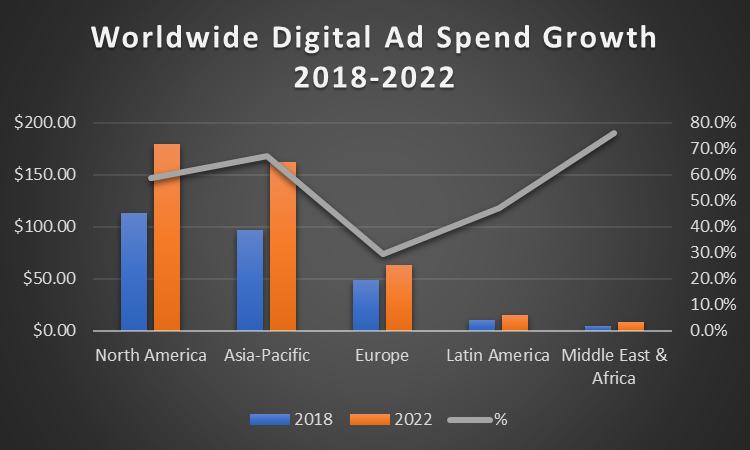

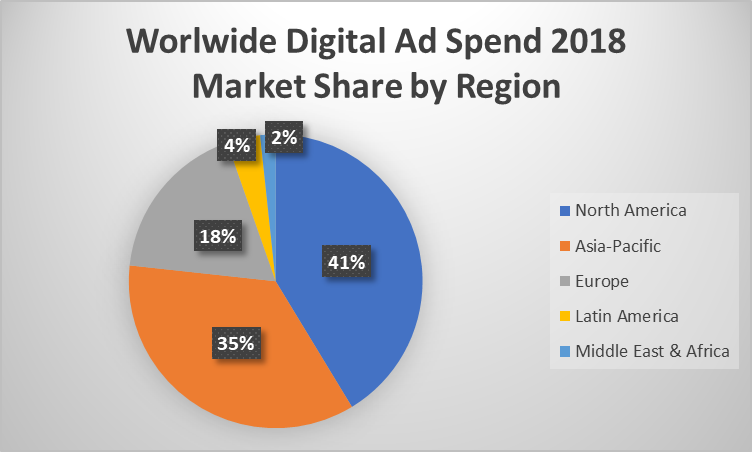

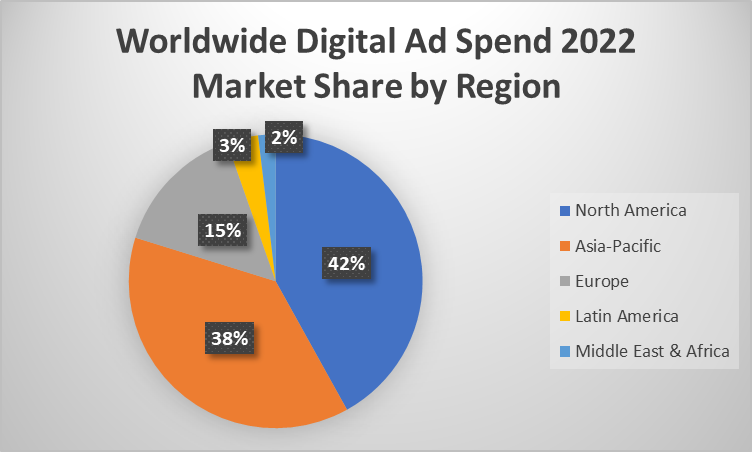

Worldwide digital ad spend is projected to grow by 56% in the next four years, from $273 billion in 2018 to $427 billion in 2022.

The fastest growing regions will be in the Middle East & Africa at 76%, followed by Asia-Pacific at 67% and North America at 59%.

Despite being a fairly large market, Europe will see much slower growth compared to all of the other regions at just 30%.

North America will continue to be the dominant market for digital advertising, accounting for 42% of the digital ad spend in 2022. The Asia-Pacific region will see a 3% increase in the next four years to 38%, while Europe will see its market share in digital advertising decrease from 18% to 15%.

Worldwide Mobile Ad Spend

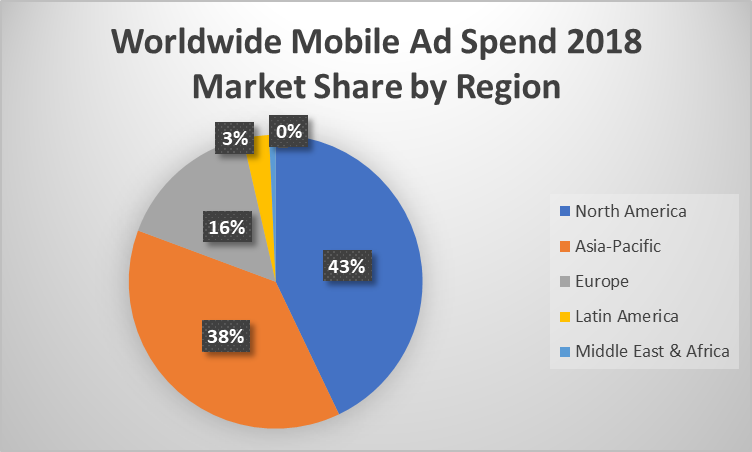

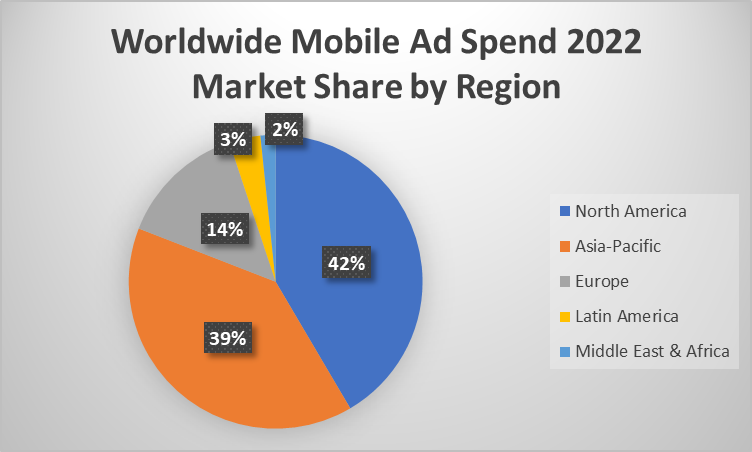

If we take out all other digital forms of advertising such as tablets and desktop and focus solely on mobile, the picture of the world changes once again.

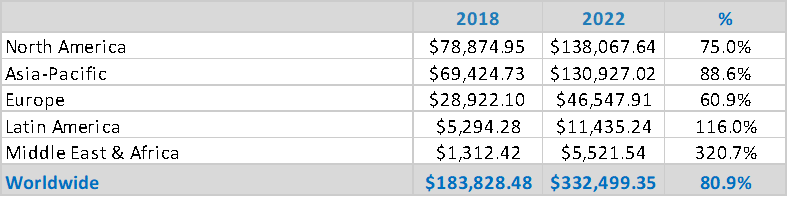

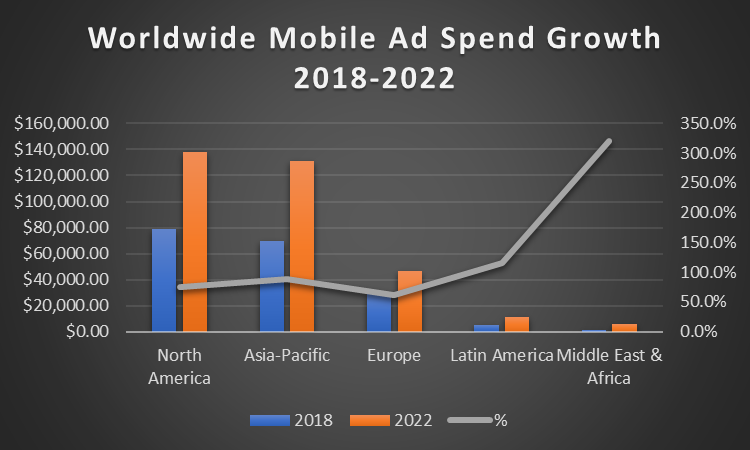

Mobile advertising around the world is expected to grow roughly 20% per year until 2022, from $184 billion in 2018 to $332 billion in 2022.

The biggest growth will occur in the Middle East & Africa where growth will explode by 320%. Latin America will also see strong growth at 116%.

Interestingly, whereas digital ad spend in Latin America is growing at a rate lower than North America and Asia, mobile ad spend is growing at a higher rate than these two regions.

Here’s how mobile ad spending looks over the next four years.

North America will continue to be the largest market for mobile ad spend in 2022, followed by the Asia-Pacific. Europe will see its share decrease from 16% to 14%.

That is the broad picture of the entire world and which regions are growing the most.

The trends are obvious. The big growth is taking place in Asia. North America is not far behind. Europe is growing the least.

But what about specific countries? We’ll take a look at them here.

Soaring Ad Growth in Asia

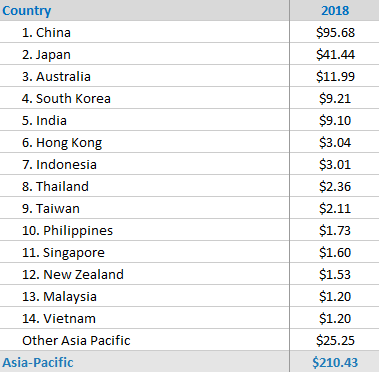

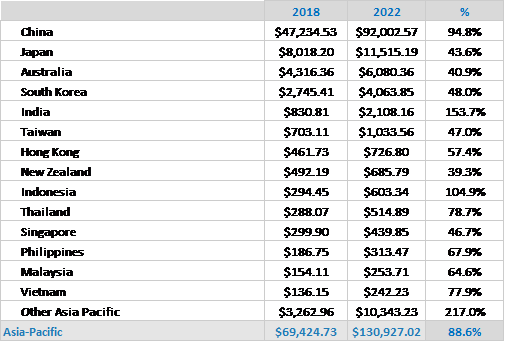

Here are the top countries in the Asia-Pacific region by Total Media ad spend in 2018.

And here’s where those same countries stand four years from now in 2022.

As we can see, a few things have changed. India has jumped up to the third largest market in the Asia-Pacific, pushing back Australia and South Korea.

We also see Indonesia become the sixth largest market, replacing Hong Kong which only grows a marginal 3% in the next four years.

The rest of the list largely remains the same.

Here are the countries ranked by growth rates.

When it comes to total media spend in the Asia Pacific, India will grow the most in the next four years, posting growth rates of 53%. China follows at 50%, and Indonesia at 27.6% and Vietnam at 19%.

It’s interesting to see that while China is posting enormous growth rates, Chinese-speaking countries like Taiwan, Singapore and Hong Kong are growing at a fraction of the rate, at 7.6%, 3.1% and 3% respectively.

It’s also interesting to see that while Vietnam is growing by a strong 19.2%, neighboring Thailand will only grow 4.2%. This is despite the fact that Thailand has a similarly-sized population and location. The same can be said of the Philippines which will only grow by 10.4%.

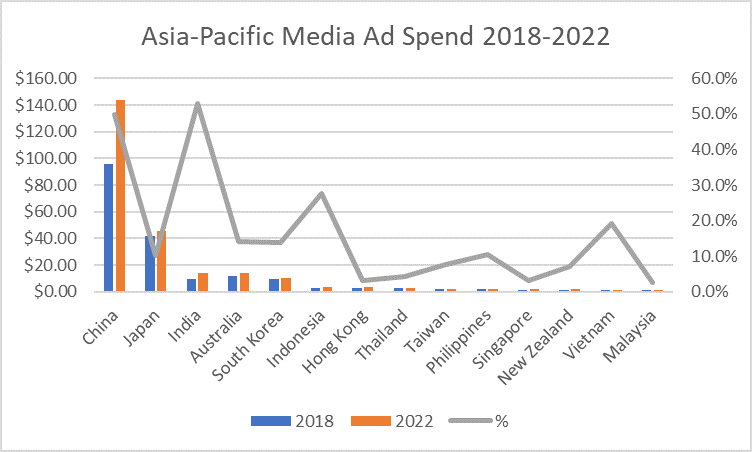

Here is a final chart which summarizes the data.

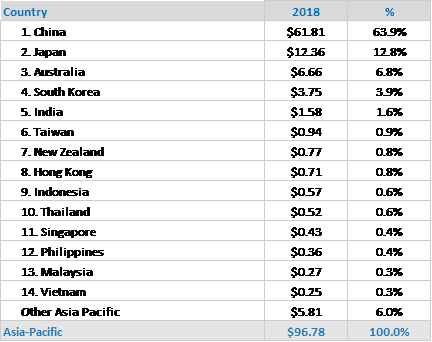

Asia-Pacific Digital Media Ad Spend

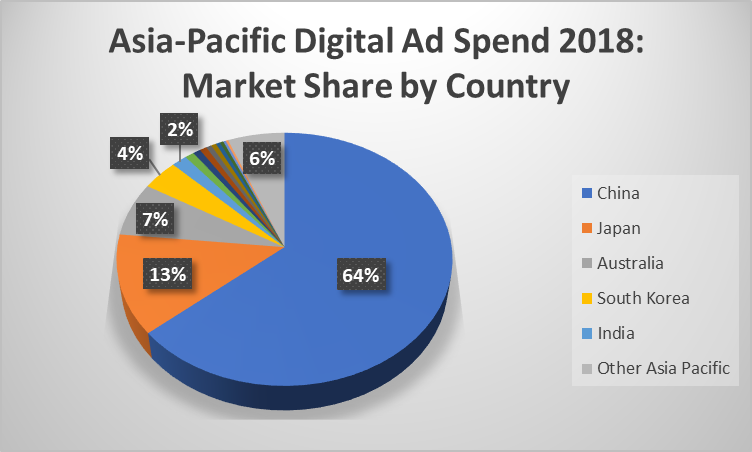

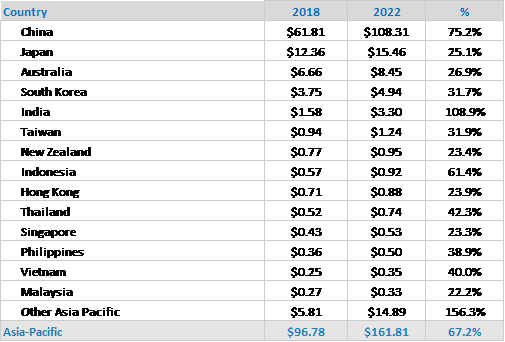

Digital media ad spend in the Asia-Pacific region is expected to total $96.78 billion in 2018.

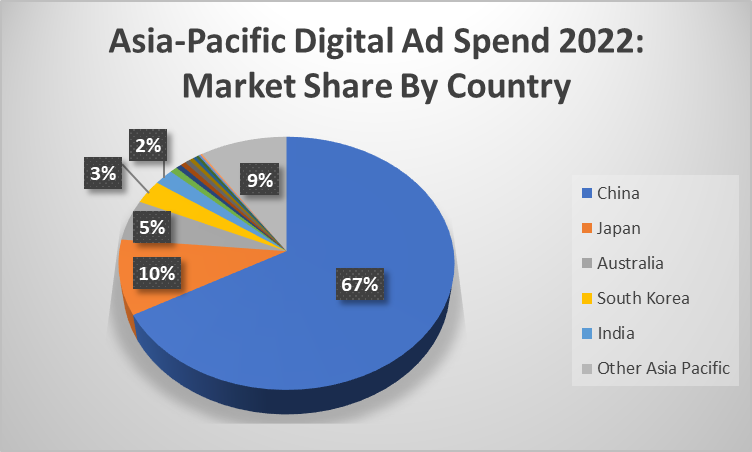

China dominates digital ad spend, accounting for 64% of the $96 billion in digital ad spend in 2018.

Japan follows at nearly 13% and then Australia and South Korea.

Despite its huge population, India will make up just 1.6% of digital ad spend in the Asia-Pacific in 2018.

Here is how digital ad spending will change in the Asia-Pacific region four years from now in 2022.

China’s share of digital ad spending will increase by 3% from 64% to 67%. The biggest decline will come from Japan, which will shrink from 13% to 10%. Australia also will sink back from 7% to 5%, along with South Korea from 4% to 3%. At the same time, India will grow from 1% to 2%.

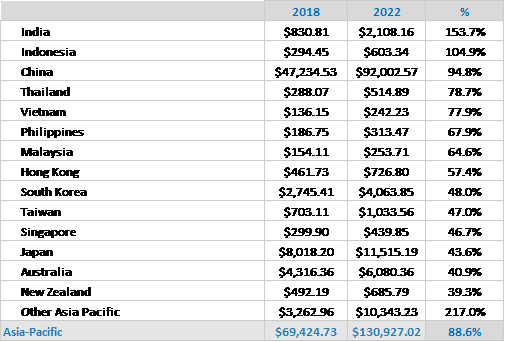

By 2022 the list of countries in the Asia-Pacific region will largely remain the same, but certain countries will see massive growth.

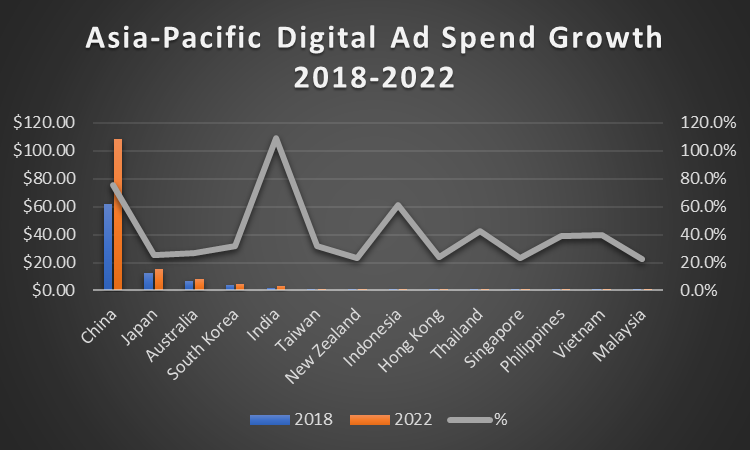

Here is this data visualized.

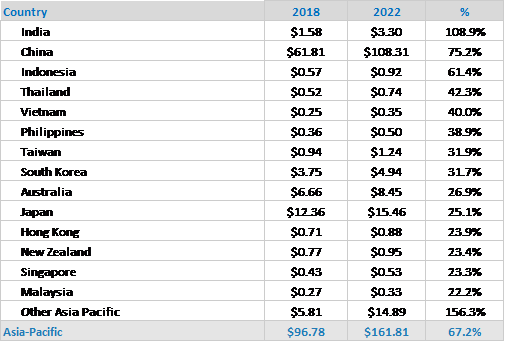

Here are the countries ranked by growth rates.

India will see the most digital ad spend growth in the Asia-Pacific, followed by China at 75%. A host of other countries in Southeast Asia will also see large growth, including Indonesia at 61.4%, Thailand at 42.3%, Vietnam at 40% and the Philippines at 38.9%.

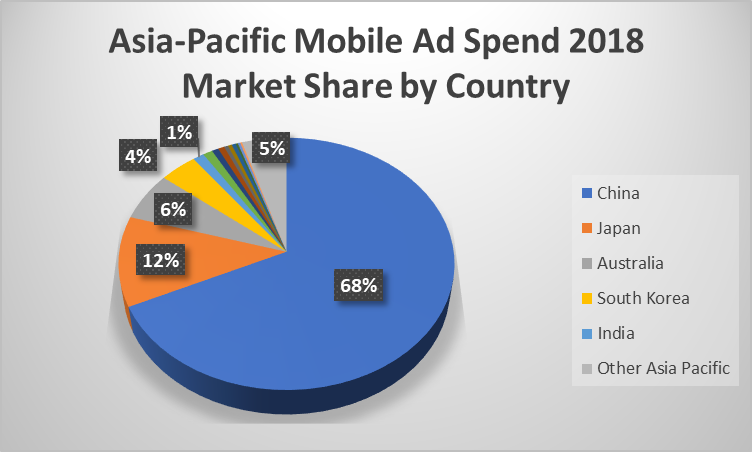

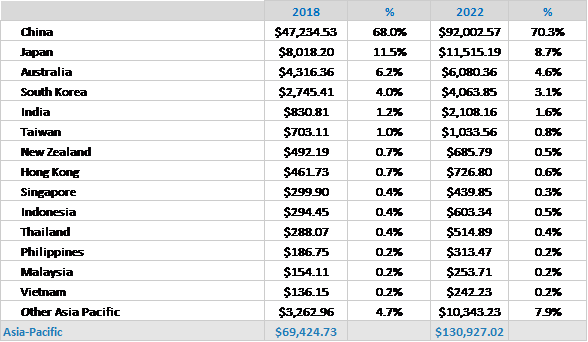

Asia-Pacific Mobile Ad Spend

If we take out desktop and tablets and only focus on mobile phones, we get some more slight changes in Asia.

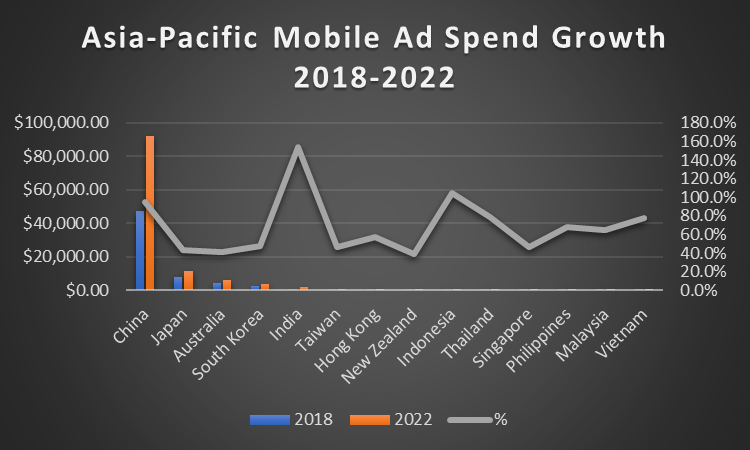

China’s share of mobile ad spend in 2018 stands at 68%.

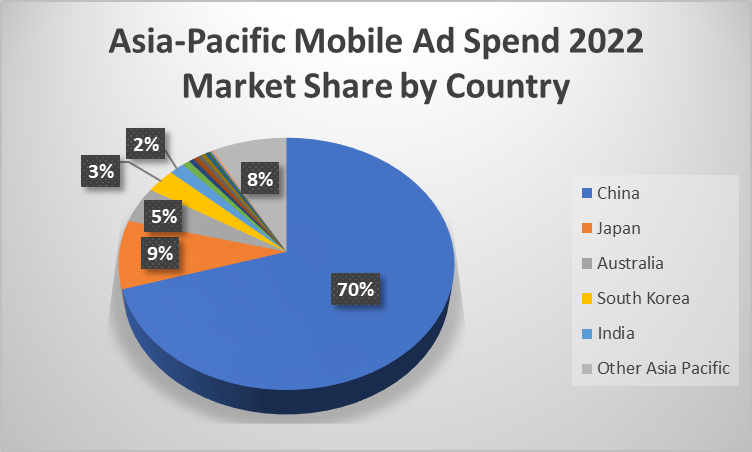

Four years from now we see China boost its share to 70.3%. At the same time, Japan’s market share falls from 11.5% to 8.7%, Australia’s from 6.2% to 4.6% and South Korea’s from 4% to 3.1%.

If we add Taiwan and Hong Kong, China’s share of mobile ad spend gets pushed up to nearly 72%.

Although China will undoubtedly be the biggest market, the highest growth in mobile ad spend will occur in India, which will see growth of 153%.

Other countries in Southeast Asia will also see very strong growth including Indonesia at (104.9%), Thailand (78.7%), Vietnam (77.9%), the Philippines (67.9%) and Malaysia (64.6%).

The entire Asia-Pacific region will see mobile ad spend grow 88.6% during this period. Here are the countries ranked by growth rates.

Steady Ad Growth in Latin America

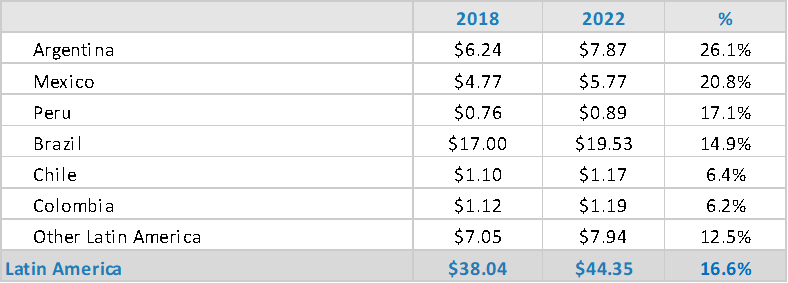

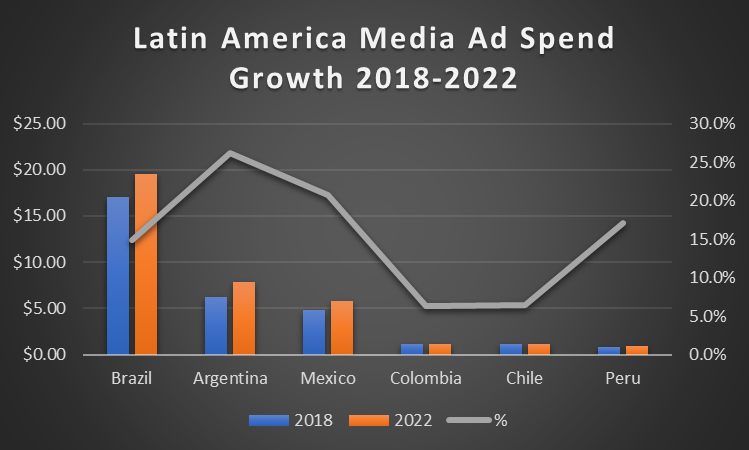

Latin America will see total media ad spend grow 17% over the next four years, from $38 billion in 2018 to $44 billion in 2022.

Compared with other regions, this is lower than North America and Asia-Pacific, but above Europe, and largely in line with the Middle East & Africa.

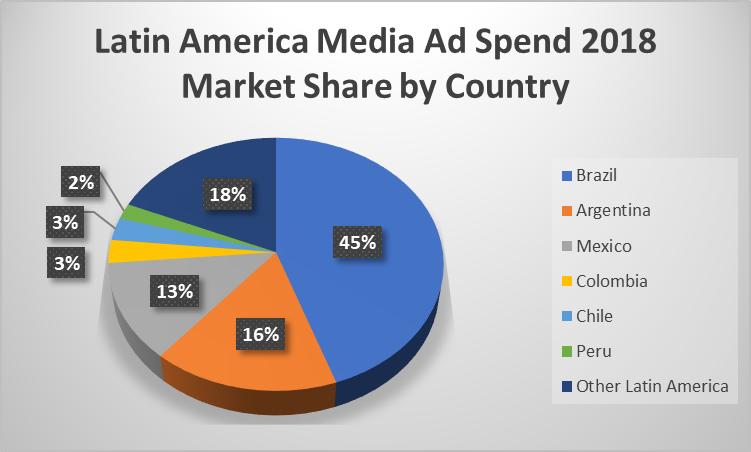

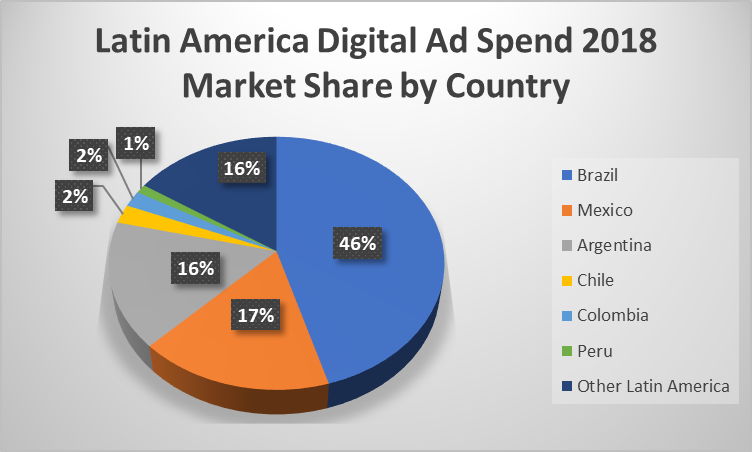

In 2018 Brazil accounted for 45% of total media spend in Latin America. Argentina follows at 16% and Mexico at 13%.

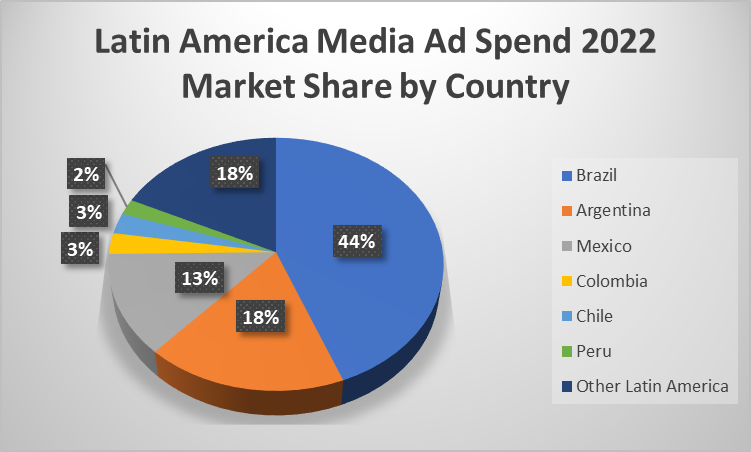

By 2022 the picture in Latin America changes slightly, with Brazil dropping from 45% to 44% market share and Argentina growing from 16% to 18%.

Argentina will see the biggest media ad spend growth over the next four years at 26.1%, followed by Mexico at 20.8% and Peru at 17.1%. Brazil will grow by 14.9%.

Interestingly, Argentina remains a larger market than Mexico, despite Mexico having a population of 124 million compared with Argentina’s 44 million. Mexico’s proximity to the United States and its similar level of GDP per capita as Argentina would suggest that there would be more media ad spend in the country, but that is not the case.

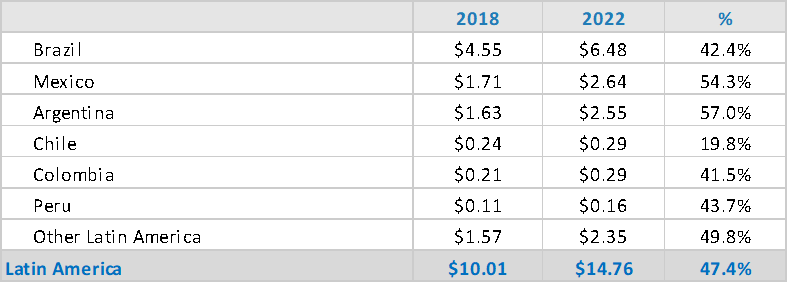

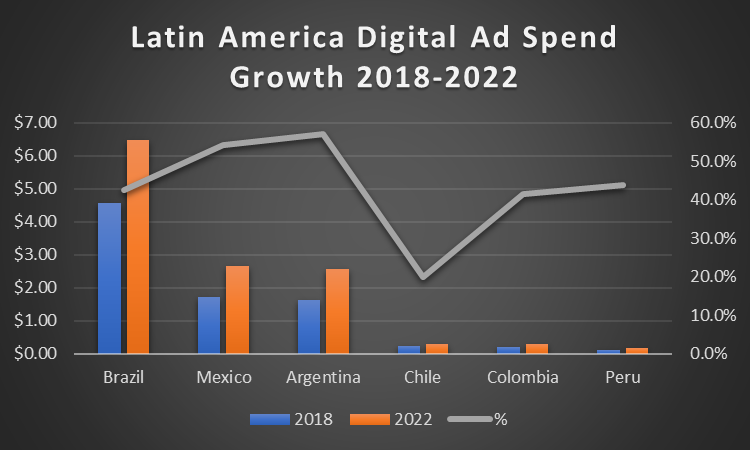

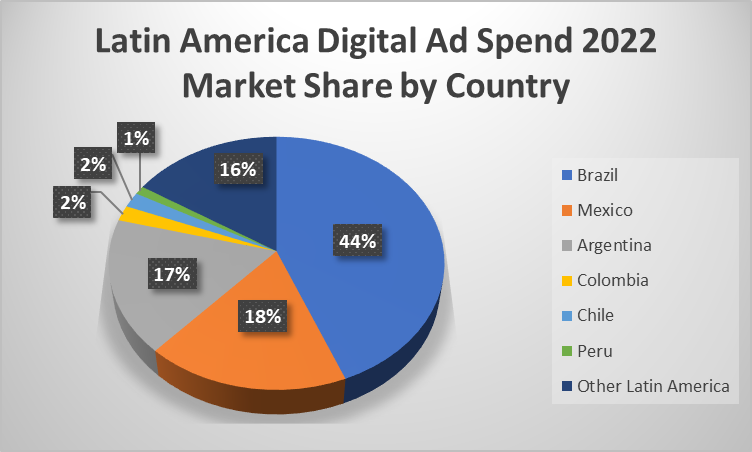

Latin America Digital Ad Spend

Digital ad spend in Latin America is expected to grow by 47% over the next four years, from $10 billion to $15 billion.

That growth is below North America, the Asia-Pacific and Middle East & Africa, but above growth in Europe.

Brazil will remain the largest market, but the fastest growing countries will be Argentina and Mexico.

Interestingly, the growth is fairly evenly distributed, with the exception of Chile which will grow at a much lower rate.

Brazil will see its market share slip from 46% to 44% while Mexico and Chile will see an increase.

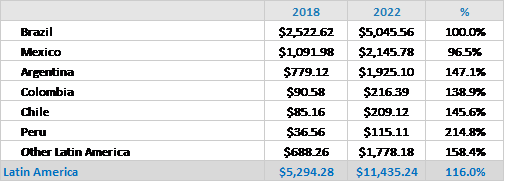

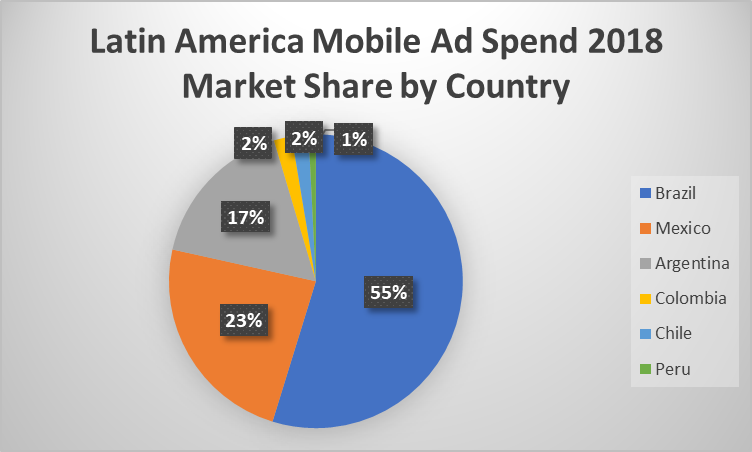

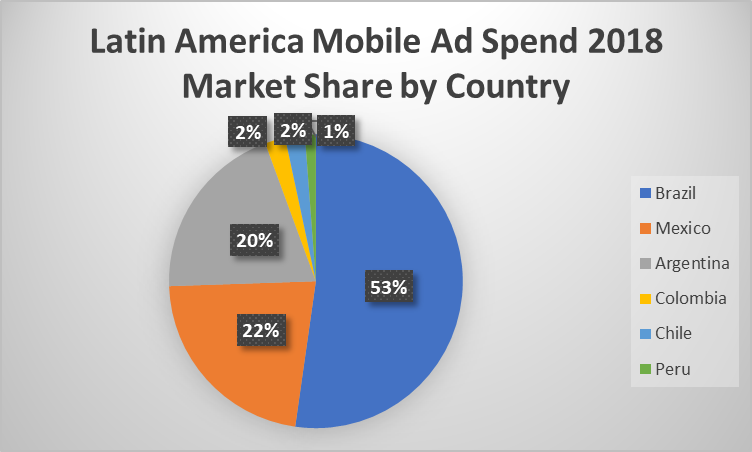

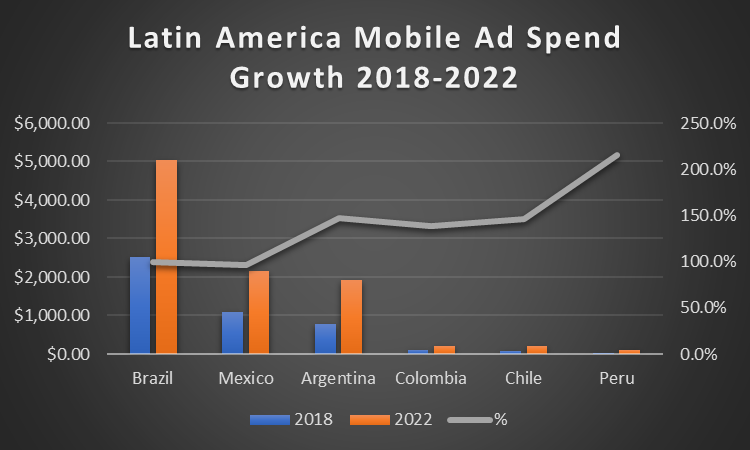

Latin America Mobile Ad Spend

Mobile ad spend in Latin America is set to grow 116% in the next four years, from $5.2 billion in 2018 to $11.4 billion in 2022.

Brazil will see its share of mobile ad spend fall from 55% to 53%, while Argentina will see an increase from 17% to 20%.

The fastest growing market will be Peru, which will see nearly 200% growth in the next four years. Argentina will catch up with Mexico and will most likely overtake Mexico in the years ahead if current growth rates continue.

Overall Latin America is a region that will see modest but steady growth in the next four years.

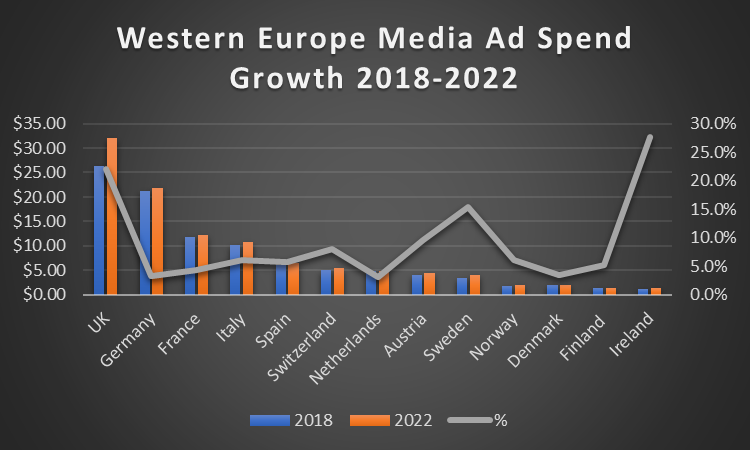

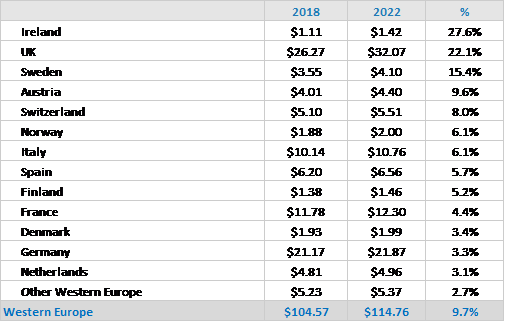

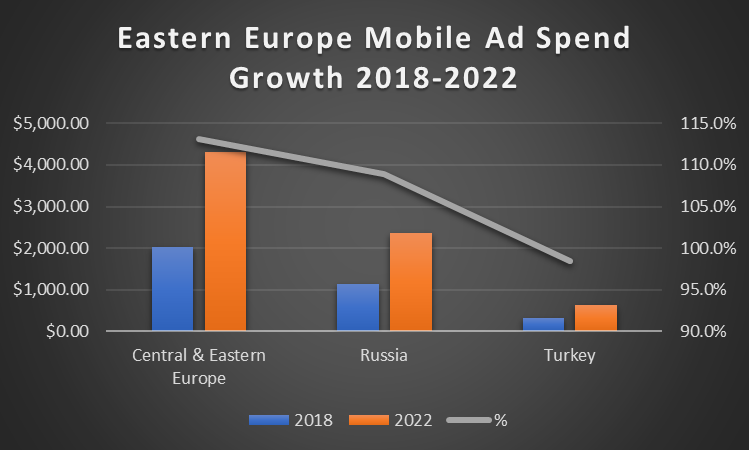

Sluggish growth in Europe

Despite strong growth in North America and Asia, one area where growth will remain suppressed in the next four years is Europe.

With the exception of the United Kingdom which will see 22% growth, all other major western European countries will grow at exceedingly low rates in the next four years.

Germany, the powerhouse of Europe with a population of 83 million, is only set to grow 3.3% in the next four years. This is especially odd given that German is also the language spoken in Austria (population 8.7 million) and Switzerland (population 8.4 million) and Luxembourg (500,000). Taken together, this is a market of over 100 million people. But despite this large market, growth remains low.

Other major countries in Europe will not fair much better than Germany. France will grow 4.4%, Italy 6.1% and Spain 5.7%.

Among smaller markets, the Netherlands will grow by 3.1%, Denmark at 3.4%, Finland at 5.2% and Norway at 6.1%.

The exception in mainland Europe is Sweden, which will grow a healthy 15.5% in the next four years.

When it comes to Eastern Europe, Russia is a fast-growing market, despite sanctions and a falling ruble. Russia's digital ad market will grow from $6.7 billion in 2018 to $8.9 billion in 2022, achieving growth of 30%. With a population of 142 million and significant Russian speaking populations in Ukraine, Belarus and other countries of the former Soviet Union, Russia could remain an attractive market in the years ahead.

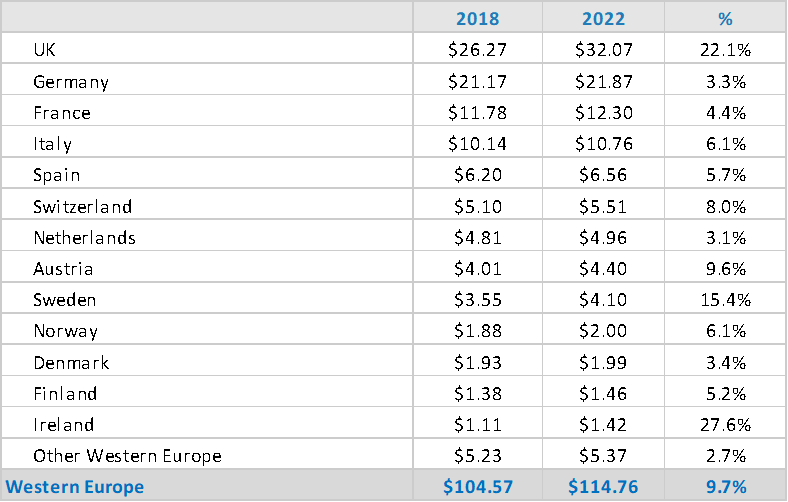

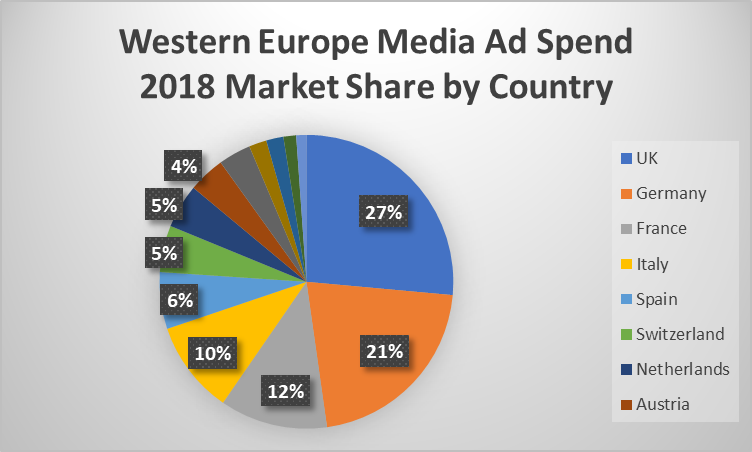

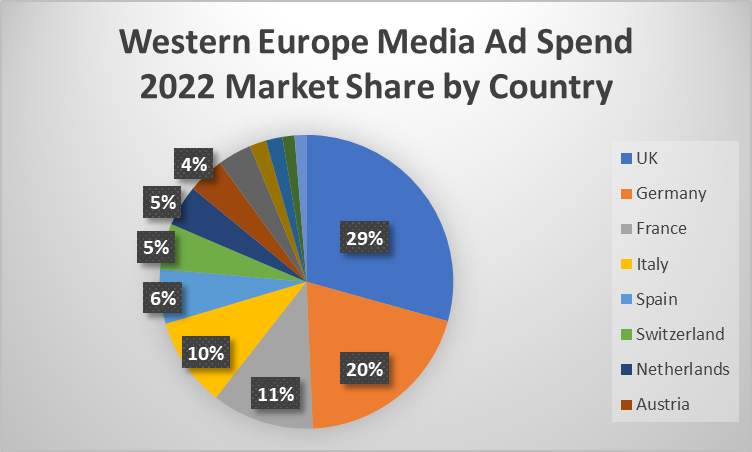

Western Europe Total Media Ad Spend

Western Europe will see the lowest total media ad spend growth compared to all other regions in the next four years at just under 10%.

The UK will remain the largest market in 2022 at $32 billion, followed by Germany at $21 billion, France at $12 billion and Italy at $10.7 billion.

The biggest growth will come from Ireland, which will grow 27.6% over the next four years.

With the exception of Ireland, the UK and Sweden, growth rates in Western Europe remain very low, with none in double digits.

The UK will see its market share of total media ad spend in western Europe increase from 27% to 29% over the next four years. Germany will see a decline from 11% to 10%.

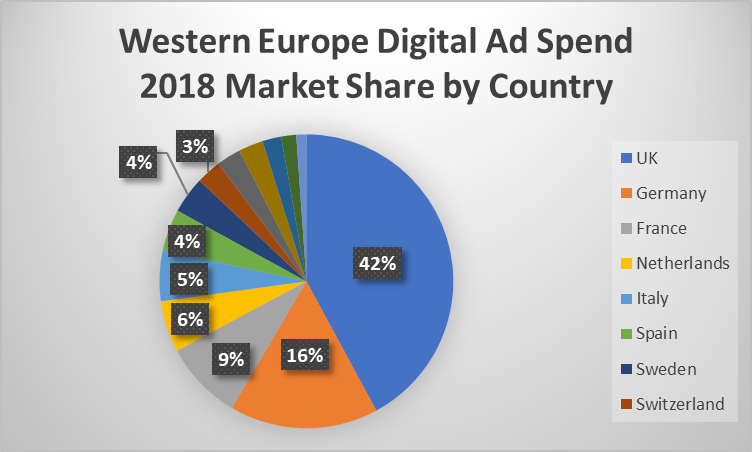

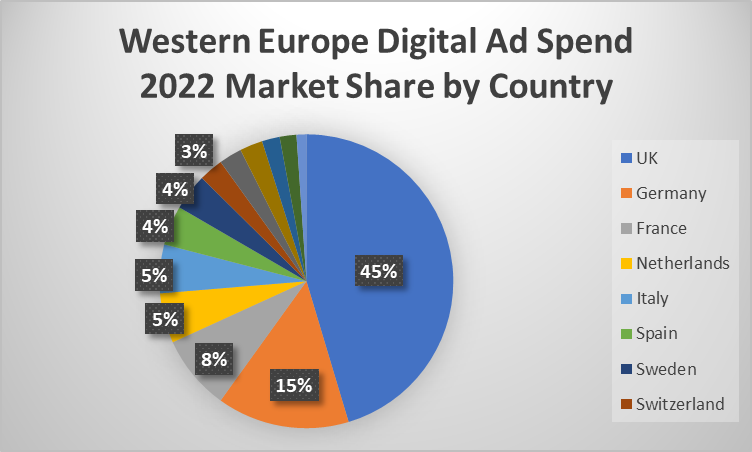

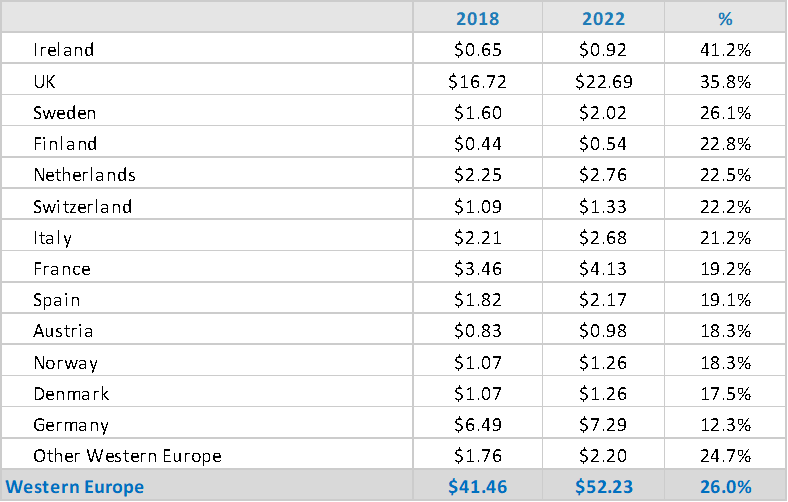

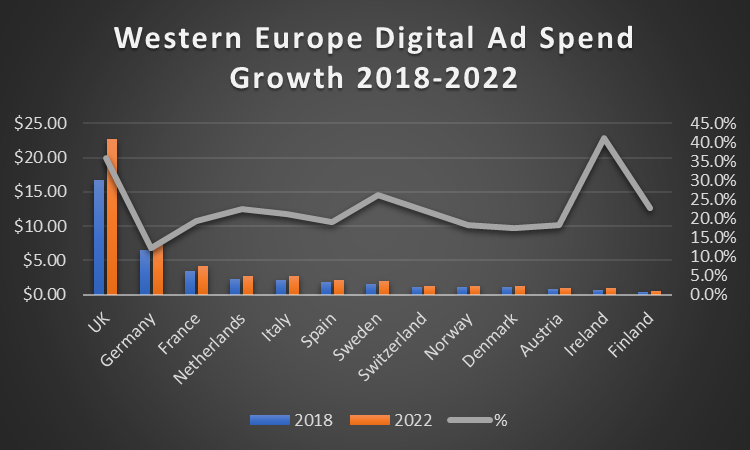

Western Europe Digital Ad Spend

Digital ad spend in Western Europe is set to increase by 26% over the next four years from $41 billion in 2018 to $52 billion in 2022.

The UK will remain the biggest market and also the second-fasting growing market.

In 2018 the UK will make up 42% of digital ad spend in Western Europe. Germany will follow at 16% and France at 9%.

Interestingly, the Netherlands has more digital ad spend than all of Italy, despite the country having a much smaller population than Italy or Spain.

By 2022 the UK will account for 45% of all digital ad spend in Europe. Germany, France and the Netherlands will see small declines.

Here are western European countries ranked by growth rates for digital ad spend.

The biggest growth will occur in Ireland and the UK, followed by Sweden, Finland, the Netherlands and Switzerland.

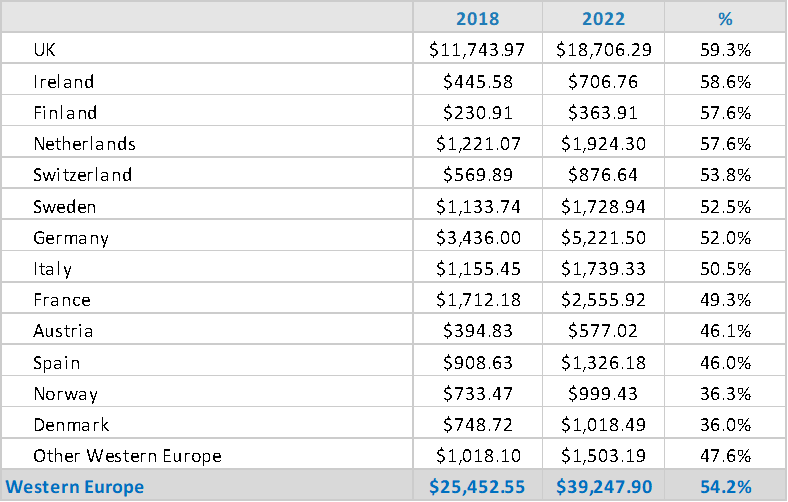

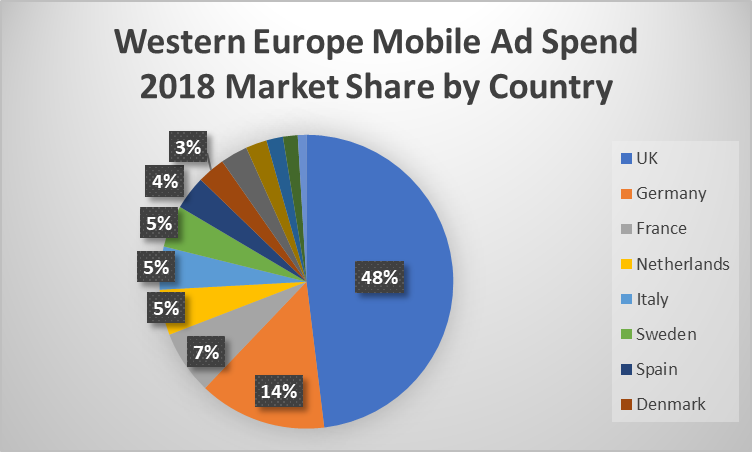

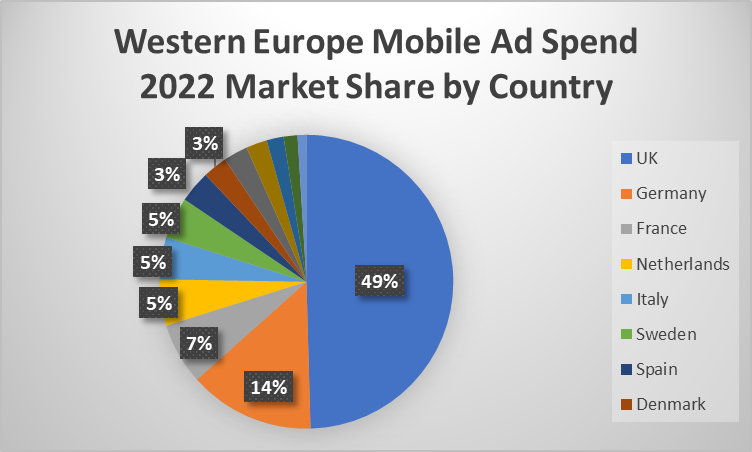

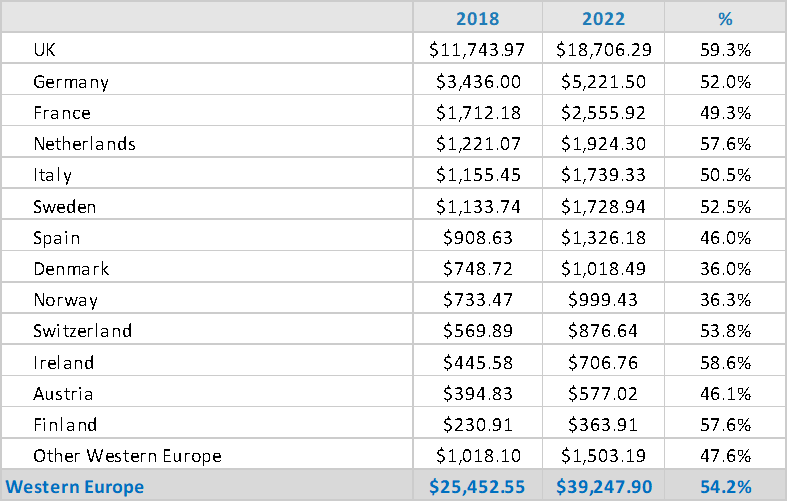

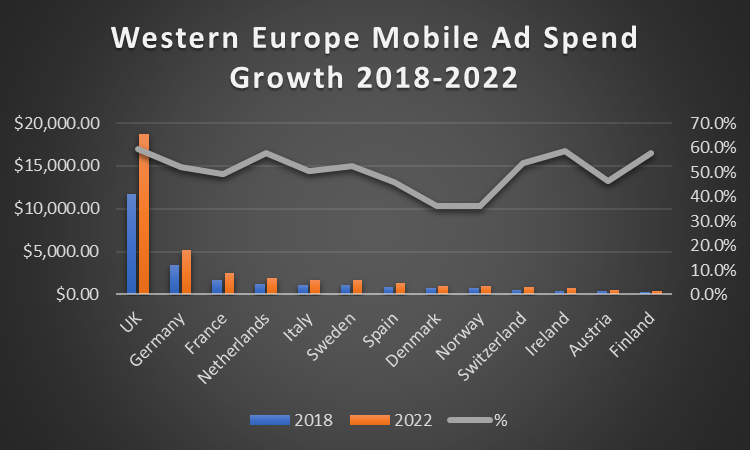

Western Europe Mobile Ad Spend

Mobile ad spend in Western Europe is expected to grow 54% over the next four years from $25 billion in 2018 to $39 billion in 2022.

The biggest growth will occur in the UK, closely followed by Ireland, Finland and the Netherlands.

The UK will also remain the largest market, accounting for nearly half of mobile ad spend in Western Europe.

Here are countries ranked by mobile ad spend in 2022.

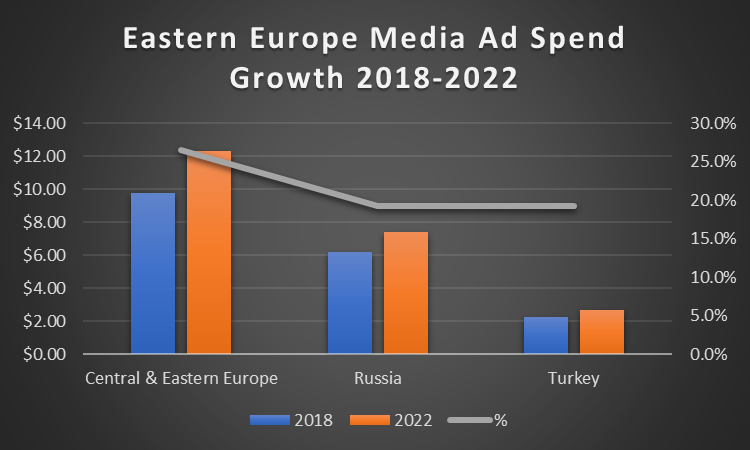

Eastern Europe Media Ad Spend

While growth in Europe’s western half is sluggish, the eastern half of Europe is seeing strong growth in advertising.

Whereas total media ad spend is only set to grow 9% over the next four years in western Europe, in Eastern Europe it will grow 23.1%.

Central & Eastern Europe will grow the most. Russia and Turkey, two country’s on Europe’s periphery but with close links to the continent will grow at basically the same rate.

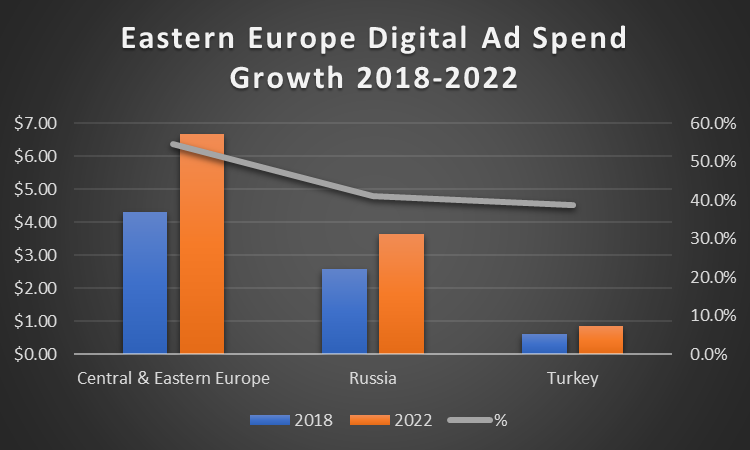

Eastern Europe Digital Ad Spend

When it comes to digital, Eastern Europe is set to grow 48.7% over the next four years, compared to just 26% for western Europe.

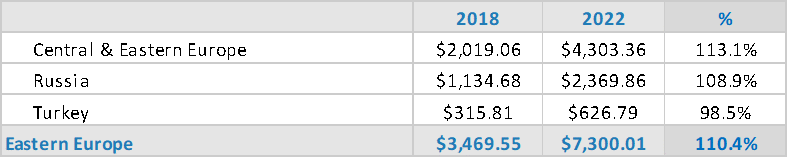

Eastern Europe Mobile Ad Spend

Mobile ad spend in Eastern Europe will also outpace that of western Europe, with growth expected at 110% compared to 54% for western Europe.

Who are the winners?

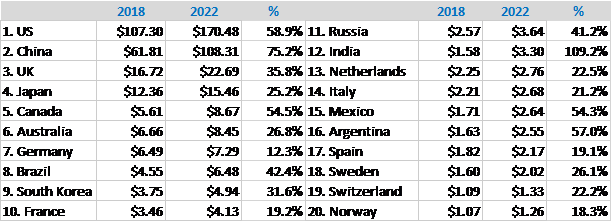

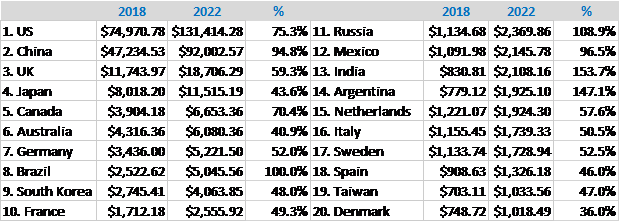

If we rank by country, this is what the list of the 20 biggest markets for total media ad spend will be in 2022, four years from now.

Top 20 Countries by Total Media Ad Spend in 2022

Top 20 countries by Digital Ad Spend in 2022

Top 20 countries by Mobile Ad Spend in 2022

How to make sense of the numbers

The numbers make a few things clear. First, the Asia-Pacific region is the fastest growing region in the world. Together with North America, these two regions account for almost 75% of ad spend going forward. North America may be the largest ad market right now right, but by 2022 it will have to hand over the throne to Asia.

There's also significant growth occuring in the Middle East & Africa, but the overall market remains marginal in size compared to other regions.

India is an interesting country. Although with a population of over 1 billion, the report reveals that it is simply a much smaller market overall compared to China. Despite this, the country will see the highest growth in its advertising market in the next four years.

Europe is struggling, with growth rates in Western Europe particularly suppressed. The exception is the United Kingdom and Ireland that are set to grow at rates in line with the United States in the years ahead.

The United States, of course, will remain the largest advertising market in 2022. China will close the gap, but the day when China overtakes the United States is still a long ways away.

You can play around with the numbers and read the full eMarketer report here.

Try Aori

Want to take full advantage of this global growth in your digital advertising strategies? We built several smart advertising solutions specifically designed to capture international digital advertising markets. Give them a try.